WHERE WE INVEST

WHERE WE INVEST

We look to invest in innovative companies with strong underlying growth. With incremental capital investment, these businesses can generate attractive returns on investment and further accelerate organic growth.

We target businesses at inflection points in their operating models and aim to identify strategic business that can become targets for acquisition. We specifically seek companies that are post VC-funding, but pre-IPO (or large scale private equity capital)

Investment Profile

Lower Middle-Market

$25 – $200 million in Enterprise Value

$5 – $50 million investments, but will consider lower/higher investments with co-investors

Both control and minority investments

Equity or Debt/Equity investments

Company Attributes

Impact innovation

Sustainable competitive advantages

Attractive growth opportunities

Marketed products

Regulatory Compliant

Management

Long track record working with entrepreneurs/founders

Proven managers with successful history of driving value creation

Strong alignment of interests and equity ownership

Industry Focus

Tech-enabled Business Services

FoodTech

Fintech

Industrial Technology

Geography

North America

Europe

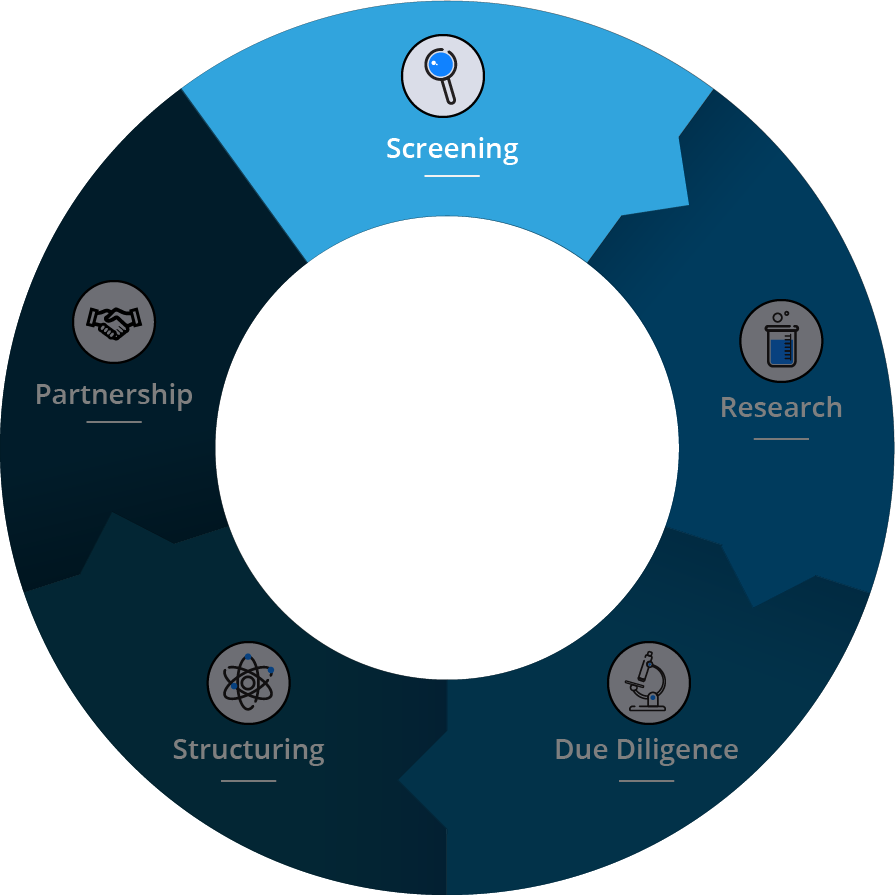

HOW WE INVEST

We have our investing process down to a science. Each of our portfolio companies goes through a four-stage lifecycle that ensures mutual growth for all parties involved.

SCREENING

TIME FRAME

Completion within 1 to 2 weeks from initial contact

MATERIALS

An executive summary

OUR WORK

An internal review reveals if the company fits within our existing portfolio and meets the criteria of the fund

OUTCOME

If this initial internal review is positive, a meeting of introduction is arranged between our team and the entrepreneur and/or key business members. In many cases, introductory meetings are followed by further talks to get preliminary questions from both sides answered. Our team must unanimously support further analysis before moving forward

RESEARCH & ASSESSMENT

TIME FRAME

Completion 4 to 8 weeks from initial contact

MATERIALS

A complete business plan with financial reports, forecasts, market and competitor analysis’.

OUR WORK

Our team performs a complete verification of the business plan (including strategy and all documents mentioned above) by enlisting the help of 3rd parties and appropriate experts when needed. During this phase, our team may begin early discussions regarding potential deal structure. The team also begins to consider possible exit scenarios.

OUTCOME

Verification is deemed approved and parties move forward to the next stage, or our team communicates that we can’t pursue the opportunity

DUE DILIGENCE

TIME FRAME

6 to 8 weeks

MATERIALS

Contact information for all business lines and complete due diligence on all relevant parts of the business.

OUR WORK

A group consisting of our core team and any relevant experts from our partnerships will make site visits to meet and interview all key members of the company at all business locations. This also a crucial time for our team to get a feel for how relationships will be built between individuals and groups at all sides of the table and to start to lay down a roadmap that would lead to the Fund exit.

OUTCOME

Productive and engaging relationships are established amongst all parties

DEAL STRUCTURING

TIME FRAME

Completion 2 to 4 weeks

MATERIALS

Parties exchange and agree on all legal documents

OUR WORK

We will pursue talks until all parties’ concerns are satisfied. Our team begins by talking to co-investors and identifying appropriate milestones and deal expectations in order to begin the closing

OUTCOME

The investment is made

ONGOING PARTNERSHIP

TIME FRAME

Ongoing throughout the life of the partnership

MATERIALS

Quarterly reports: management analysis, forecasts, expectations and discussion

OUR WORK

Regular updates, which include meetings with management to discuss direction and strategy. Address and resolve any and all queries and concerns. Share knowledge and experience with the fund’s portfolio and expert network

OUTCOME

Develop and scale enterprises that continue to create positive social, environmental and economic returns to all stakeholders; analysis of exit scenarios.